1 min read

2022: Putting Offshore Big Data in the Spotlight

Having established TrueOcean in November 2019, our focus in the early years was of course on developing our Marine Data Platform (MDP) in line with...

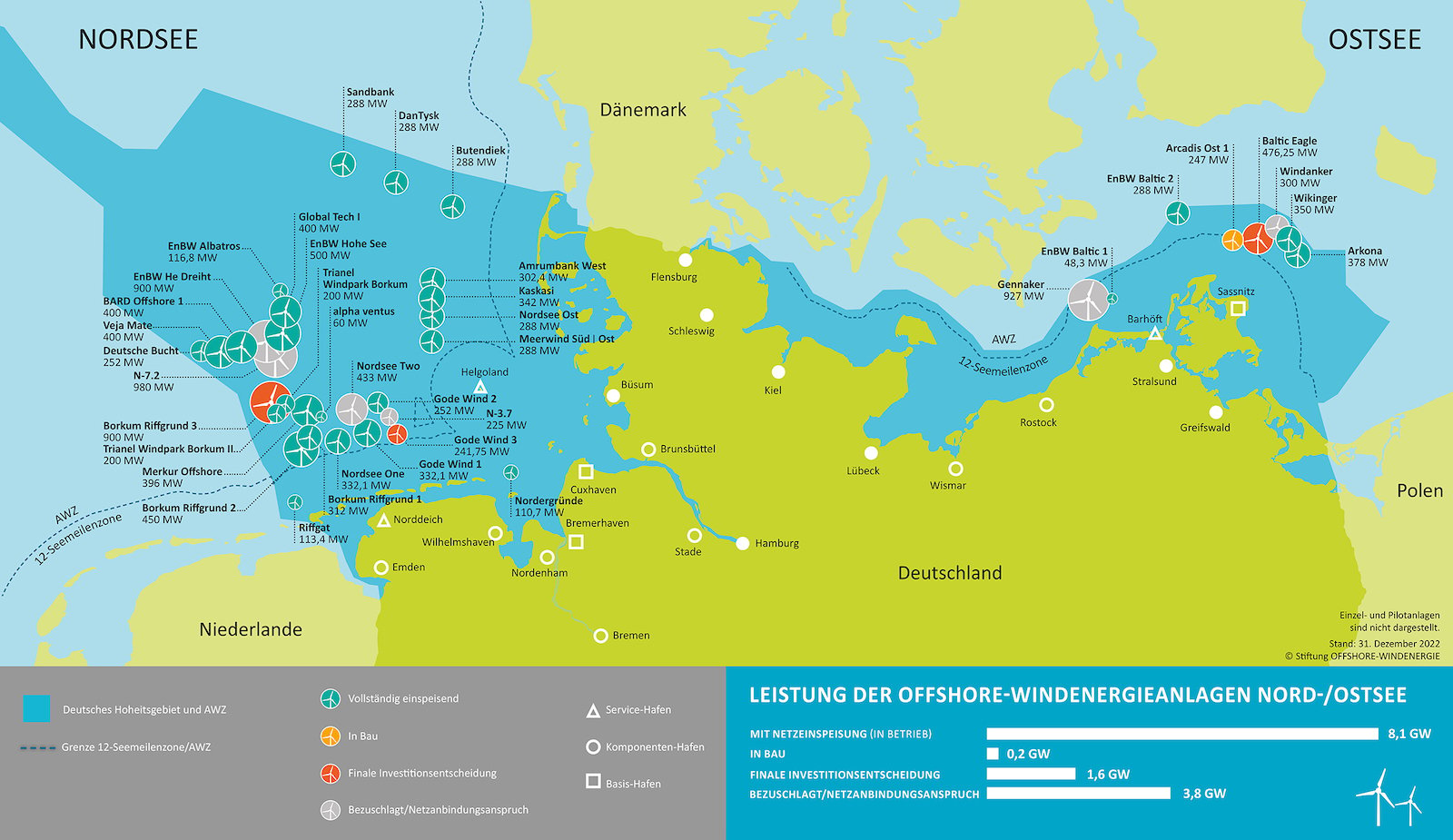

The German government could not have chosen a more appropriate date for the resurrection of the energy transition. On Maundy Thursday 2022, the cabinet passed the amendment to the Renewable Energy Sources Act. The "Easter package" had it all: by 2030, the share of renewable energies in Germany's gross electricity consumption is to almost double. In this decade, 80 percent of our electricity would be generated in a climate-friendly way. Today it is just under 50 percent. To achieve this, Germany wants to triple its pace in the expansion of renewables. Especially in solar energy and offshore wind. Currently, there are wind farms with a capacity of 7.7 gigawatts off the German coasts in the North and Baltic Seas. In less than eight years, there should be at least 30 gigawatts - 50 percent more than in earlier federal plans. By 2045, the federal government plans an installed capacity of 70 gigawatts off our coasts - ten times more than today.

Unlike the first wind power boom fifteen years ago, the euphoria in the industry is still limited. Caution is more the right word: 2022 was a good year for installed wind turbines, which generated 18 percent more electricity than in the previous year and, at 122 terawatt hours, made the largest contribution to green electricity production in Germany. Nevertheless, the expansion of wind power has been in the doldrums for years.

The decline began in 2018: suddenly, only half as many onshore and offshore wind turbines were built as in the previous year. New capacity fell from 6.5 to not even 3.4 gigawatts. And it fell further to 1.7 gigawatts by 2021. In the current year 2022, just 352 megawatts of new wind capacity were connected to the grid. The causes can largely be attributed to politics, which in the last decade cut wind power subsidies, reduced tendering areas, piled up new bureaucratic hurdles and slept through the expansion of the electricity grids for the transport of energy to the industrial regions in the south. The result was a wave of bankruptcies in the young boom industry, many thousands of skilled workers lost their jobs. The ambitious expansion targets from the Easter package are now relying on an industry that has almost dissolved in this country.

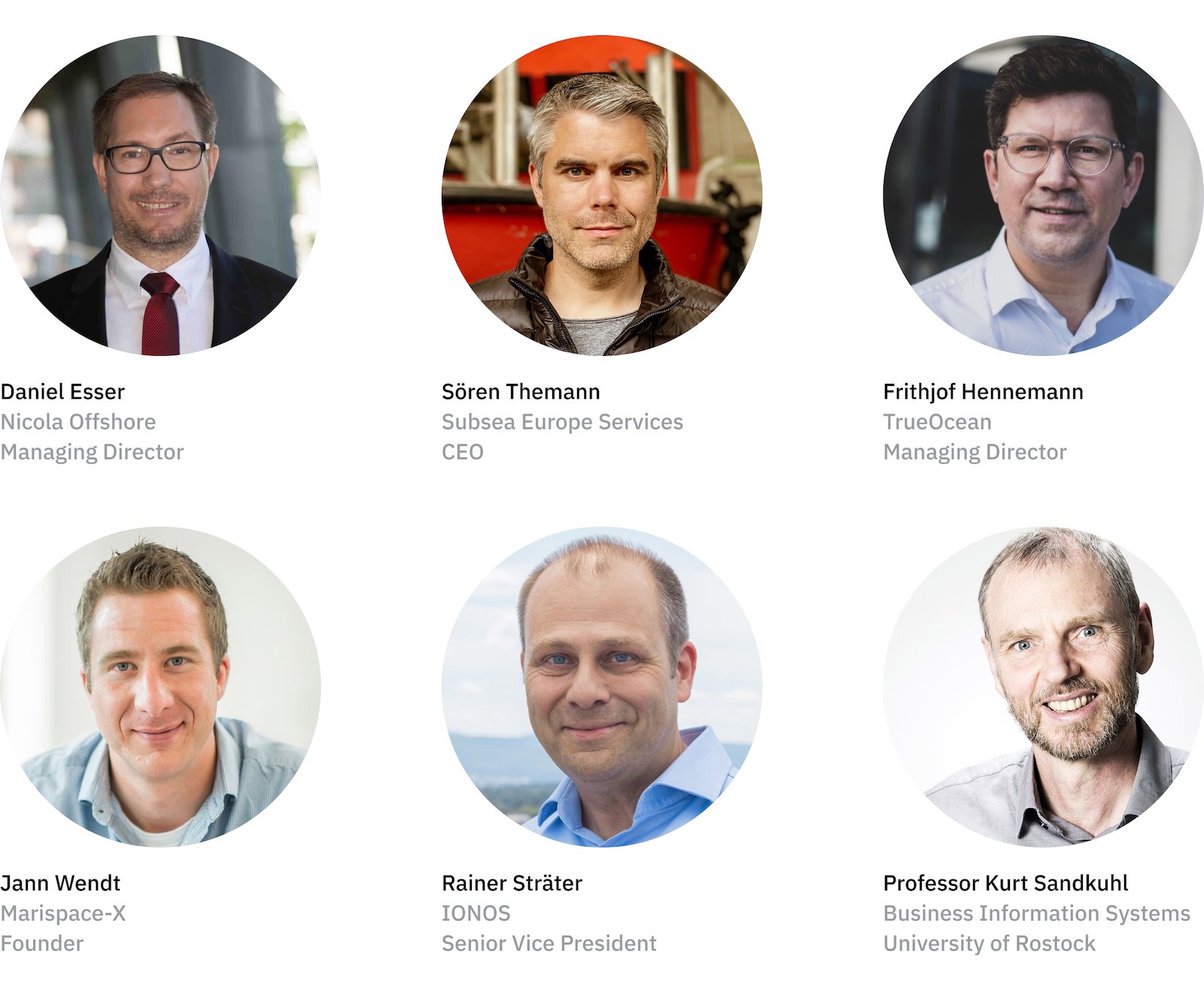

That's why Daniel Esser doesn't want to grow in the traditional sense by hiring more staff and buying new ships, i.e. betting on the upswing with a lot of capital: "We're scaling on the technology side, in the efficiency of our processes and in productivity."

His company, Nicola Offshore, northwest of Hamburg, sends ships packed with state-of-the-art measurement technology and engineers out onto the continental shelf. There, his small fleet collects sensor data to map the seabed, detect World War II munitions storage sites or check submarine cables. Among his most important customers are energy companies that have to draw up plans, build foundations, operate and continuously maintain turbines for more offshore wind farms than ever before.

Esser's company belongs to a new generation of start-ups whose business models address a weak point of the maritime sector: costs. Especially the costs caused by data.

In the case of an offshore wind farm, these are already incurred on a large scale before construction begins. Its planners have to scan the construction site for the foundations to check the suitability of the seabed, ocean currents and stones and munitions remnants. What would be done quickly on land sometimes takes weeks at sea and costs tens of thousands of euros - per day.

"Not only expensive special technology is used on our reconnaissance trips. On board, highly qualified measurement engineers and technicians control the entire sonar campaign, check the incoming raw data and prepare it for later analysis," explains the economist and former submariner.

Compared to much larger competitors, Nicola Offshore, with four of its own survey vessels, including three fast catamarans, specialises in near-shore exploration missions, rapid deployment and high data quality. "We are literally the fast boats in the business. We keep our operations as lean and compact as possible and offer all digital data handling as a package," says Esser.

There is great interest in the maritime industry: subsidy reductions and competitive tendering procedures are forcing operators of capital-intensive offshore wind farms in particular to relentlessly reduce their costs and achieve efficiency gains. As a result, the price of wind power has fallen drastically in recent years. Today, wind turbines are more profitable than polluting coal and gas-fired power plants, even on the high seas.

In the long term, Esser hopes that technology will bring the marginal cost of collecting a new set of data at sea closer to zero. A second company in which he has a stake is also working on this and represents a new stage in offshore data collection.

New technologies such as autonomous surface and underwater vehicles, artificial intelligence (AI) and smarter hydroacoustic systems promise to further accelerate and streamline marine surveying. Subsea Europe Services GmbH, also based around Hamburg is heavily involved in these areas, with an ultimate goal of providing solutions that enable the cost of marine data to reduce to such a level that survey companies can go out and acquire it without a client commission, and only charge when it’s required.

Managing director Sören Themann soon wants to send out entire swarms of autonomous vehicles to carry out even complex measurement campaigns without risk to human crews and at significantly lower costs: "These swarms can be launched and serviced from larger autonomous ships or from any manned vessel. We have successfully tested the use of autonomous sonar drones in combination with manned 'mother ships' and can cover a larger area and collect high-quality data faster under different conditions. The concept works," says Themann.

The ability to operate several vehicles simultaneously with a mother ship at the centre of the network represents a paradigm shift in offshore surveying, says the marine geologist and economist: "In the future, the use of small, flexible and autonomous vehicles will reduce the cost per data package to such an extent that we will be able to carry out surveys when conditions are optimal - even without a prior client order. This has the potential to fundamentally change the way end users look at buying and using marine data."

Specialists such as Nicola Offshore and Subsea Europe are continually optimising the physical side of data acquisition. But the data itself and the way it is handled also offer great potential for innovation in the maritime sector.

The five oceans of the world may all be connected, but the data of maritime industries is not. Their owners lock data away in private silos and on local servers. The exchange is done cumbersomely over land, not infrequently still by sending hard disks by post.

One reason is the confusion of proprietary and outdated data formats and IT systems. Many techniques and methods for processing and analysing data date back to the 20th century.

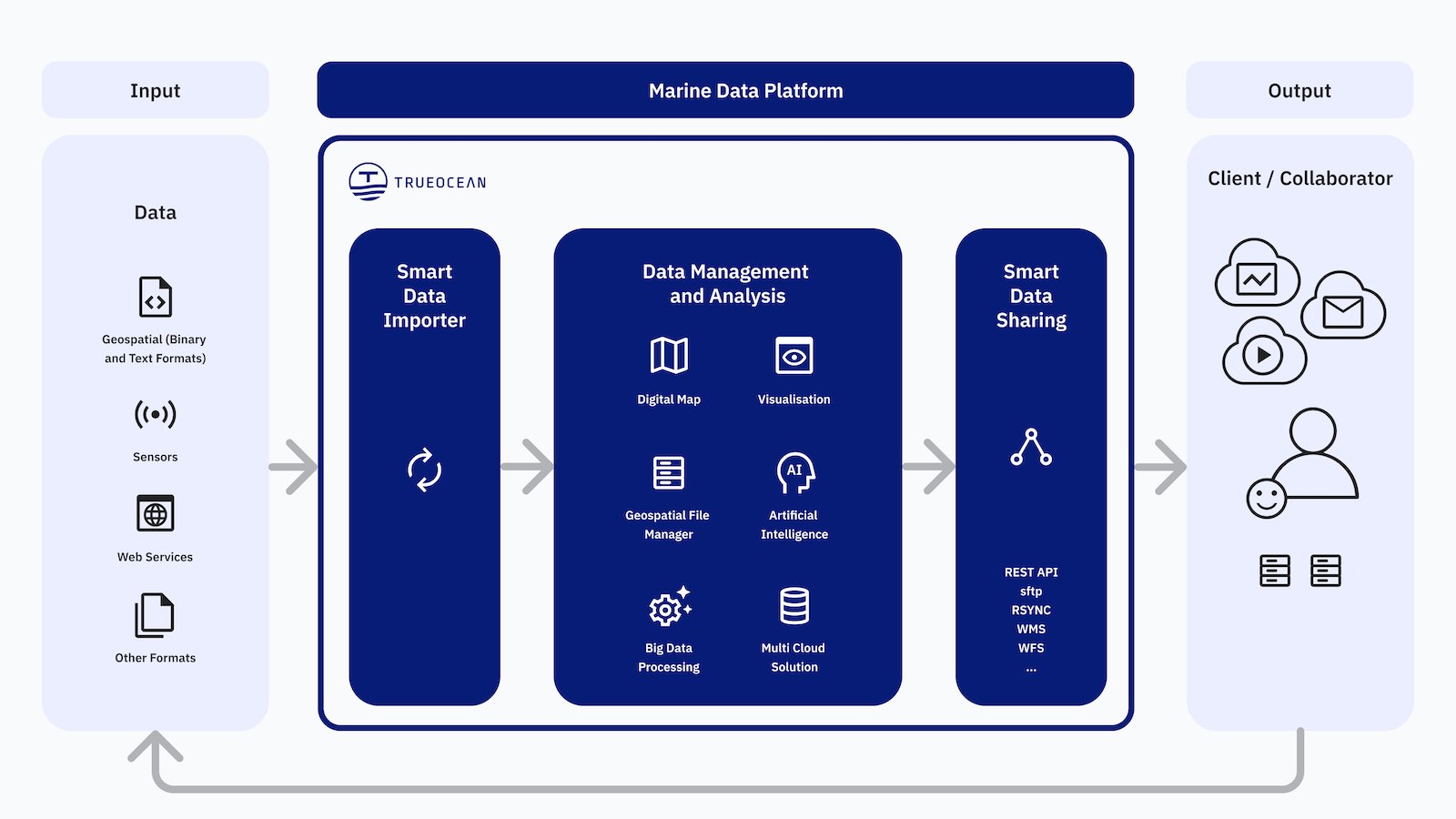

TrueOcean is filling this gap: the start-up from Kiel's Science Park, just a stone's throw from the Unicampus, has built a cloud just for marine survey data. The platform offers industry-specific tools to store and manage sensor and metadata and share it with approved partners internally, and if desired, externally. The aim is to dissolve data silos in an organisation and make marine survey data available on one platform, without the need to licence expensive, data format specific software for every single user or stakeholder.

There is still no standard format for different sensor data, explains Frithjof Hennemann, managing director of TrueOcean: "A multibeam echo sounder from manufacturer X stores its raw data in a different format than the echo sounder from competitor Y." Some measurement data is still stored in formats that were developed decades ago for storage on magnetic tape drives. "Reading out each format requires its own special software, which costs additional license fees and bloats the local IT," says the lawyer and economist.

This also makes the use of non-industry cloud platforms uneconomical. Here, maritime customers first have to laboriously download their data back to local systems for each processing step because the proprietary software programs are only available there. But every data transfer on a public cloud costs money.

And dealing with maritime data is also demanding and unwieldy on the content level, as Subsea Europe Services founder Sören Themann knows: "When we record the coordinates of a measuring point in the sea, for example, the altitude relative to a local reference point is relevant in addition to the geographical longitude and latitude. But since the Earth is not an ideal rotational ellipsoid, but has humps and dents, every thorough measurement requires a local correction factor, the so-called 'datum'." For an error-free and uniform database, therefore, even today highly paid experts have to manually reconcile and prepare raw and metadata. Such processes cannot be automated, not to mention the subsequent analysis of the data - at least until now.

Because the TrueOcean Cloud creates a uniform database for the first time by converting all raw sensor data into a universal open-source format. This not only makes expensive special software for reading out the data superfluous. Processes for quality control and refinement of raw sensor data can be automated and also simplify subsequent analysis with AI algorithms.

Soon, the start-up also wants to offer specialised applications for analysing the data directly on its platform. "Customers will then be able to book analysis modules as software as a service, for example, generic statistics modules, visualisation filters or interactive maps with geolocations, all the way to complex, AI-based procedures that become more and more powerful as the data volume and quality grows and are also transferable to other use cases," says Hennemann. The TrueOcean CEO and his colleagues already have their sights set on the next development step.

TrueOcean's cloud is embedded in the future European data ecosystem Gaia-X. "This will also allow our customers to connect external clouds and data sources to our platform via interfaces, without compromising on data sovereignty and user-friendliness," says Hennemann. The compatibility with the emerging European data infrastructure offers customers even greater cooperation opportunities with project and business partners for their data, adds Hennemann.

The idea behind Gaia-X is for cloud providers and data owners to join forces in data rooms. Here, user companies can combine cloud services at will and exchange data securely and sovereignly according to European rules and data protection standards. Unlike today's cloud market, the ecosystem is intended to provide transparency and comparability in the actual service attributes of each offering: such as the location of the data, accessibility by external personnel, permitted data use by third parties, certification level according to existing standards or the applicable legal framework.

Europe's largest cloud provider IONOS SE is one of the founding members and drivers of Gaia-X. The IT company from Montabaur also supplies the physical infrastructure for the TrueOcean cloud. Rainer Sträter, who is responsible for the cloud business at IONOS SE and played a major role in the Gaia-X standards, wants to improve the economic efficiency of digital processes through industry-wide data rooms: "Without common rules, a company has to define the exchange of data, its use and conformity with applicable data protection rules bilaterally in a contract with each individual cooperation partner. This creates an insane amount of work and drives up the costs of digital cooperation. Gaia-X creates for the first time a universally valid framework for the entire European Union."

The initiators of Gaia-X include IT service providers, as well as user companies from fourteen sectors, NGOs, research institutions and associations from all over Europe. Together with the Gaia-X organisations, they are gathering requirements, developing technical concepts, including the reference architecture for Gaia-X and basic services for the data economy in the EU and beyond.

The federal element in Gaia-X is typical for Europe. This is because the data spaces are organised along themes, value chains and sectors. The pilot projects for the maritime data space, for example, are running under the name Smart Maritime Sensor Data Space X, or Marispace-X for short. The founding members include cloud provider IONOS, TrueOcean and north.io.

The project participants are developing rules and procedures for the secure and trustworthy handling of data in a maritime data ecosystem. "We want to make maritime data usable, refine it partly already on site, i.e., under water and at sea, and link it securely with data from other sources. To this end, we are working out and defining the requirements of our industry and bringing them into the design of a European cloud ecosystem," says Jann Wendt, initiator of Marispace-X.

Marispace-X comprises four application-oriented pilot projects that are being driven forward together with various partners: "We are looking at the management of underwater data for offshore wind farms, the data-based and AI-supported search for old munitions in the North Sea and Baltic Sea, the optimised cultivation of seagrass meadows as a natural CO2 store, and even the Internet of Underwater Things (IoUT)," says Wendt.

Wendt does not yet know what new business models will result from a maritime data space: "This is a learning process: Marispace-X creates the conditions for sharing data with each other in a sovereign manner in the first place. In this way, the maritime players get to talk to each other and find out together how their data can be utilised when it is no longer locked away in their own treasure chests."

Professor Dr. Kurt Sandkuhl has been researching digital business models for years. The holder of the Chair of Business Informatics at the University of Rostock sees data spaces and a European ecosystem of data spaces as a prerequisite for digital business models to develop on a broad scale at all: "Silicon Valley relies heavily on monopolies when it comes to creating value from data. The alternative is an open ecosystem in which data owners share their information and market it to third parties. This also gives start-ups and SMEs the chance to build digital business models in cooperation with others. Especially in niches like the maritime sector, this approach offers opportunities for innovation."

According to Sandkuhl, the entry into data-based business models triggers an evolution in the affected industries: Companies would have to find their role in the newly emerging data markets. "Like farmers, cooperatives, dairies and traders in the dairy industry, new roles are forming in data-based markets for data collectors, data refiners as well as data brokers. Companies will blend their data with that of trusted partners to distil more valuable products," says Sandkuhl. In the end, he says, there has to be a place where supply and demand come together. "How else do I know who is offering relevant data in the first place?" asks Sandkuhl.

But work is already underway on this development step as well: In the long term, Frithjof Hennemann plans to expand the TrueOcean cloud into a marketplace for data products. Driven by the offshore wind industry's rapidly growing demand for more efficient data solutions, maritime start-ups are transforming the role of digital data from cost driver to catalyst for new business opportunities.

1 min read

Having established TrueOcean in November 2019, our focus in the early years was of course on developing our Marine Data Platform (MDP) in line with...

TrueOcean will exhibit at WindEurope 2023, one of the year’s largest wind energy events, this April. Taking place at the Bella Center in Copenhagen...

Hamburg, Germany. Jann Wendt, CEO of cloud geospatial data specialist north.io spoke this week at the International Conference on Advances in...

We are thrilled to announce our participation at WindEurope 2024, taking place from March 20th to 22nd in Bilbao. As one of the leading events in the...